“2025 guide to choosing the best cybersecurity insurance”

Related Articles

- “managing Third-party Risk In Data Security Strategies”

- “cost Analysis Of Cybersecurity Solutions For SMEs In 2025”

- “AI-driven Threat Detection Tools For Businesses”

- “how To Choose The Best Cybersecurity Consultant For Your Business”

- “top Data Breach Prevention Tools For Businesses 2025”

Introduction

Discover everything you need to know about “2025 guide to choosing the best cybersecurity insurance”

Cyberattacks are more sophisticated, frequent, and devastating than ever before. While robust cybersecurity practices are paramount, even the most meticulously secured organizations are vulnerable. This is where cybersecurity insurance steps in, acting as a crucial safety net in the face of increasingly complex threats. However, navigating the world of cybersecurity insurance policies can be daunting. This comprehensive guide unveils the big secret tips and tricks to help you choose the best policy for your organization in 2025 and beyond.

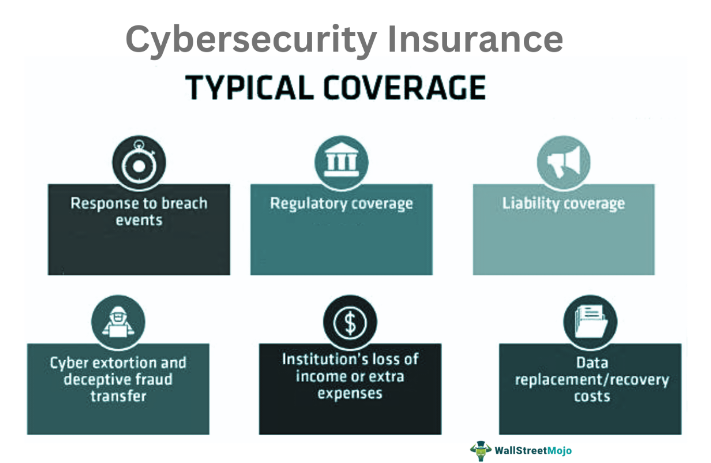

1. Beyond the Basics: Understanding the Nuances of Coverage

Many organizations approach cybersecurity insurance with a simplistic "one-size-fits-all" mentality. This is a dangerous oversight. In 2025, a successful policy hinges on understanding the granular details of coverage. Don’t just focus on the headline figures; delve deep into the policy wording.

Secret Tip #1: Look beyond the basic cyber liability coverage. This typically covers legal costs and settlements arising from data breaches. Instead, investigate add-ons such as:

- Extortion coverage: This protects against ransomware demands and other forms of digital extortion. In 2025, sophisticated ransomware attacks targeting critical infrastructure are expected to increase, making this crucial.

- Business interruption insurance: This covers lost revenue and operational expenses resulting from a cyberattack that disrupts your business. The longer a business is down, the more costly the recovery. Ensure the policy adequately covers your projected downtime costs.

- Data recovery and restoration: This covers the costs associated with recovering and restoring your data after a cyberattack. This includes not only the technical aspects but also potential legal and regulatory fees.

- Public relations and crisis management: A major breach can severely damage your reputation. This coverage helps manage the public fallout, including legal and PR costs.

- Incident response coverage: This covers the costs of hiring cybersecurity experts to investigate and mitigate a cyberattack. Speed is crucial in incident response, and this coverage ensures you can access the best talent immediately.

Secret Tip #2: Don’t underestimate the importance of "silent cyber" coverage. This covers losses from cyberattacks that aren’t explicitly caused by a third-party breach, such as internal errors or system failures. Many traditional policies don’t cover this, leaving a significant gap in your protection.

2. The Importance of a Thorough Risk Assessment

Before even contacting insurers, conduct a thorough risk assessment of your organization. This involves identifying your vulnerabilities, assessing the likelihood and potential impact of different cyber threats, and prioritizing your risks.

Secret Tip #3: Engage a qualified cybersecurity expert to conduct the risk assessment. An independent assessment provides an unbiased view of your security posture, which is vital when negotiating with insurers. This assessment should be detailed and include specifics on your IT infrastructure, data storage methods, employee training programs, and existing security measures.

Secret Tip #4: Document your security controls meticulously. Insurers will want to see evidence of your proactive security measures. This includes details on firewalls, intrusion detection systems, antivirus software, employee training programs, and incident response plans. A well-documented security program demonstrates your commitment to mitigating risks and can significantly influence your premium.

3. Negotiating the Best Policy Terms

Cybersecurity insurance is not a commodity; it’s a negotiated contract. Don’t just accept the first offer you receive.

Secret Tip #5: Compare quotes from multiple insurers. Different insurers have different underwriting criteria and policy terms. Shop around to find the best coverage at the most competitive price. Don’t solely focus on the premium; consider the overall value and breadth of coverage.

Secret Tip #6: Negotiate the policy terms. Don’t be afraid to push back on unfavorable clauses or limitations. For instance, negotiate higher coverage limits for specific risks, clarify ambiguous wording, and ensure the policy aligns with your organization’s specific needs.

4. Understanding Exclusions and Limitations

Every insurance policy has exclusions and limitations. Carefully review these to identify potential gaps in your coverage.

Secret Tip #7: Pay close attention to exclusions related to specific types of attacks, such as those targeting specific software or systems crucial to your business. Also, understand the limitations on coverage amounts, deductibles, and the claims process.

5. The Role of Your Broker

A knowledgeable insurance broker can be invaluable in navigating the complexities of cybersecurity insurance.

Secret Tip #8: Choose a broker specializing in cybersecurity insurance. They possess the expertise to understand the nuances of different policies, negotiate favorable terms, and guide you through the claims process. They act as your advocate, ensuring you get the best possible coverage.

6. Staying Ahead of the Curve: Policy Renewal and Future-Proofing

Cybersecurity threats are constantly evolving. Your insurance policy needs to keep pace.

Secret Tip #9: Regularly review your policy and make adjustments as needed. This includes updating your risk assessment, reviewing coverage limits, and adapting to emerging threats. Don’t wait until renewal to reassess your needs. Proactive adjustments ensure your protection remains relevant and effective.

7. The Human Element: Employee Training and Awareness

Cybersecurity insurance is not a substitute for robust security practices.

Secret Tip #10: Invest in comprehensive employee training programs to raise awareness of cybersecurity threats and best practices. Human error remains a significant vulnerability, and a well-trained workforce is your first line of defense.

8. Claims Process: Preparation is Key

Understanding the claims process is crucial. Knowing what to do in the event of a cyberattack can minimize disruption and maximize the chances of a successful claim.

Secret Tip #11: Develop a detailed incident response plan that outlines the steps to take in the event of a cyberattack. This plan should include procedures for containing the attack, preserving evidence, and notifying the insurer. A well-defined plan demonstrates preparedness and facilitates a smoother claims process.

Frequently Asked Questions (FAQs)

Q: How much does cybersecurity insurance cost?

A: The cost varies significantly depending on factors such as your organization’s size, industry, revenue, risk profile, and the level of coverage you choose. Premiums can range from a few thousand dollars to hundreds of thousands of dollars annually.

Q: What information do insurers need to provide a quote?

A: Insurers will request detailed information about your organization, including your industry, revenue, number of employees, IT infrastructure, security controls, previous cyber incidents, and data processing activities. They may also request a copy of your risk assessment.

Q: What happens if I make a claim?

A: The claims process typically involves reporting the incident to your insurer, providing documentation of the incident and related losses, and cooperating with the insurer’s investigation. The insurer will then assess the claim and determine the amount of coverage to be provided.

Q: Can I get cybersecurity insurance if I’ve had a previous cyber incident?

A: It’s possible, but it may be more challenging to secure coverage, and the premium may be higher. Transparency with insurers about past incidents is crucial.

Q: What if my insurer denies my claim?

A: If your insurer denies your claim, you have the right to appeal the decision. It’s advisable to consult with legal counsel to understand your options.

Q: How often should I review my cybersecurity insurance policy?

A: It’s recommended to review your policy at least annually, or more frequently if there are significant changes to your organization’s risk profile or security posture.

In the ever-evolving landscape of cybersecurity, a robust insurance policy is no longer a luxury but a necessity. By understanding the nuances of coverage, conducting thorough risk assessments, negotiating effectively, and staying proactive, organizations can secure the best possible protection against the escalating threats of the digital age. Remember, the secret to securing the best cybersecurity insurance in 2025 and beyond lies in preparedness, knowledge, and a proactive approach.

Source URL: [Insert a relevant URL from a reputable cybersecurity insurance provider or industry resource here. For example, a link to a resource page on a major insurance company’s website or a cybersecurity news site with articles on insurance.]

Closure

Thank you for reading! Stay with us for more insights on “2025 guide to choosing the best cybersecurity insurance”.

Make sure to follow us for more exciting news and reviews.

We’d love to hear your thoughts about “2025 guide to choosing the best cybersecurity insurance”—leave your comments below!

Stay informed with our next updates on “2025 guide to choosing the best cybersecurity insurance” and other exciting topics.